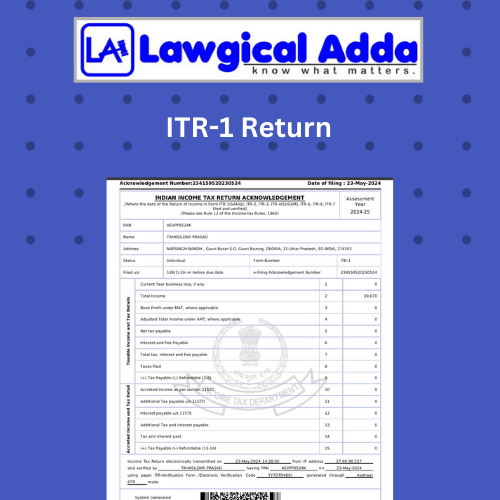

ITR-1 Return

File your Income Tax Return (ITR-1) with Lawgical Adda. Our streamlined process makes filing quick and accurate.

Keep the following documents handy:

- Form 16 (from each employer if applicable)

- Form 26AS

- Investment proofs (PPF, ELSS etc.)

- Aadhaar & PAN details

- Bank A/C info

| Pricing Summary | |

| Service Price: | ₹1000 |

| GST: | ₹180 |

| Total | ₹1180 |

| Place Order | |

Have a Question?

A Comprehensive Guide on ITR-1 Return

A taxpayer's income and tax liability for a specific financial year are detailed in their income tax return, or ITR. Individuals that receive revenue are required to file their tax filings. The most popular form for submitting income tax returns in India is ITR 1. Lawgical Adda will thoroughly explain ITR 1 in this blog, covering its features, eligibility, and filing process.

What is the Sahaj form, or ITR 1?

As you are already aware, filing an income tax return is completed by sending the income tax form to the appropriate income tax department. The tax agency notifies you of several ITR forms based on where your money comes from. One of these forms is the ITR 1 form, also referred to as the Sahaj form. In India, it's one of the most popular forms. This straightforward form is used to file your income tax return and provide the income tax department with information about your income, deductions, and taxes.

- Simple and Easy to Fill: The ITR 1 is a one-page form that just needs the most essential information, making it simple to complete and submit.

- Electronic Filing: The taxpayer does not have to send a hard copy of the form; it can be filed electronically.

- Pre-Filled Data: Some fields, like the name, address, PAN, and information on the tax deducted at source (TDS), are automatically filled in on the form.

- Faster Processing: Submitting the ITR 1 electronically guarantees that the tax return is processed more quickly.

- Verification of Income: The tax department can confirm the taxpayer's income and match it with the information at their disposal.

Who can submit a Form ITR-1 (Sahaj)?

Residents who earned up to Rs. 50 lakh during the fiscal year from any of the following sources may submit this form:

- Income and Pension

- Residential property (except situations in which losses are carried forward from prior years): This covers income from rentals or interest paid on house loans.

- Other sources include interest income from banks, dividend income, etc. (not including any lottery wins or income from racehorses).

- Income from Agriculture up to Rs. 5,000

Additionally, suppose your income is combined with that of your spouse, minor child, etc.. In that case, this return form can only be utilized if your combined income (after clubbing) likewise fits into one of the previously listed categories.

Who is not eligible to submit an ITR-1 Form?

A person whose total income for the specific financial year exceeds Rs. 50 lakh or any of the following categories is not eligible to use this Return Form:

- Non-Resident (NRI)

- Not Typically a Resident Company Director

- revenue from many residential properties or

- Past Year's pushed forward loss in real estate

- revenue from legal gambling, the lottery, racehorses, and quizzes.

- Income from selling a home, plot of land, shares, etc., falls under the heading "Capital Gains," either short-term or long-term.

- income from agriculture more than Rs. 5,000.

- revenue from a career or business.

- Loss is categorized as "Income from other sources."

- If, at any point throughout the fiscal year, you invested in unlisted stock shares

- Tax withheld in accordance with Income Tax Act Section 194N

Steps followed by Lawgical Adda to help you submit the ITR Form 1

- Contact us through our portal. Our experts will connect with you to know your requirements.

- Send our professionals all the necessary documentation.

- Our professionals will file your income tax return online using the registered site. An ITR Filing Form will be chosen based on your category, and professionals will complete all the necessary fields and claim any relevant exemptions.

- After accounting for all exemptions, our professionals will advise you of any taxes that may be due.

- Your income tax return will then be easily filed after that.

- Lawgical Adda keeps you updated throughout the process to maintain transparency.

What documentation is needed to file an ITR 1?

No attachments are needed when filing an ITR 1. Still, having the following files handy for filing is a good idea:

Your employer's Form 16 (If you changed jobs throughout the year, please provide Form 16 from each employer.) You will also require Form 26AS, AIS, and TIS Pass Details about the Aadhaar Card, PAN Card, and bank certificate, as well as tax saving deductions

Typical Errors to Avoid during ITR 1 Filing

Although filing an ITR 1 might be a simple process, taxpayers should be aware of a few typical pitfalls. Among them are:

- Inaccurate data entry: Inaccurate data entry, including PAN, bank account number, and other details, might cause inaccuracies and prolong the return's processing time.

- Not accounting for all revenue sources: All sources of income, particularly interest income, rental income, and income from investments, must be included.

- Not checking the form: The return could be deemed invalid if the form is not verified.

- Not paying taxes on time: It is essential to pay taxes on time to avoid interest or penalties.

- Failure to declare overseas holdings: Even if a taxpayer's foreign assets are not subject to taxation, they should nevertheless be reported in their tax return.

For salaried individuals filing their income tax returns, the ITR 1 is a streamlined form. It is a simple form that may be submitted online with just a few basic details. Complying with the law requires filing an ITR 1, which has various advantages, including expedited processing, income verification, and loss carryover. It is essential to gather the required paperwork and double-check the form before submitting it to prevent errors and guarantee a seamless filing process. Experts at Lawgical Adda ensure that your filing is done accurately and on time! Contact us to know more.