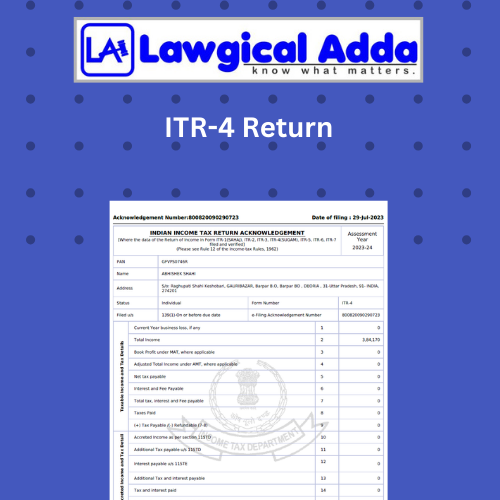

ITR-4 Return

File your business tax returns and maintain compliance seamlessly through Lawgical Adda. Get a LEDGERS compliance platform for your business.

What's included?

- GST Return Filing

- Income Tax Return Filing

| Pricing Summary | |

| Service Price: | ₹1000 |

| GST: | ₹180 |

| Total | ₹1180 |

| Place Order | |

Have a Question?

ITR-4 Return

According to Sections 44AD, 44ADA, and 44AE of the Income Tax Act, the ITR 4 Form—also called the Sugam form—is designed for taxpayers under the presumptive income plan. Small business owners that keep an approximate volume of their sales ledger rather than books of accounts must file the current ITR-4.

This covers manufacturers, wholesalers, dealers, and internet vendors. The ITR-4 form must be filed by independent contractors, including bloggers, vloggers, and web content writers. professionals such as chartered accountants, physicians, attorneys, engineers, etc.

What is the ITR 4 form?

In India, individuals, Hindu Undivided Families (HUFs), and businesses (apart from Limited Liability Partnerships, or LLPs) are required to file Form ITR-4, Income Tax Return.

Those who employ the presumptive income scheme under Sections 44AD, 44ADA, and 44AE of the Income Tax Act explicitly use this form. This program streamlines the tax compliance procedure for qualified taxpayers by enabling them to determine their income for tax purposes.

Who can submit a Form ITR-4?

If a resident individual, HUF, or firm (other than an LLP) earns the following income during the FY, they can file an ITR-4:

- Income not exceeding ₹50 Lakh

- Business and professional income, which is estimated under Sections 44AD, 44ADA, or 44AE

- Income from one house property, one pension or salary, and agriculture (up to ₹ 5,000/-)

- Additional sources, which do not include lottery winnings or revenue from racehorses, consist of:

- Interest earned on a savings account

- Interest received from a bank, post office, or cooperative society deposit

- Interest on Refund of Income Tax

- Pension for Families

- Interest accrued on increased pay

- Any additional interest income, such as that on an unsecured loan

Who is not eligible to submit an ITR-4 Form?

No person, HUF, or firm (other than an LLP) may file an ITR-4 if they are: • a resident not normally residing (RNOR) or a non-resident Indian

is a director in a company; has revenue from more than one house property; has total income surpassing ₹ 50 Lakh; has agricultural income over ₹5,000; and has the following types of income:

- lottery earnings from the ownership and upkeep of racehorses are subject to specific tax rates under Section 115BBE or Section 115BBDA.

- has deferred income tax on ESOP received from the employer as an eligible start-up, has held any unlisted equity shares at any point during the prior year, and is not subject to the ITR-4 eligibility requirements.

Steps followed by Lawgical Adda to help you submit the ITR Form 4

- Contact us through our portal. Our experts will connect with you to know your requirements.

- Send our professionals all the necessary documentation.

- Our professionals will file your income tax return online using the registered site. An ITR Filing Form will be chosen based on your category, and professionals will complete all the necessary fields and claim any relevant exemptions.

- After accounting for all exemptions, our professionals will advise you of any taxes that may be due.

- Your income tax return will then be easily filed after that.

- Lawgical Adda keeps you updated throughout the process to maintain transparency.

ITR-4 form modifications for AY 2024–2025

The modifications listed below are included in the FY 2023–24 ITR–4 form:

- The Finance Act 2023 changed Section 115BAC, which resulted in the new tax regime replacing the default one. Individuals, HUFs, AOPs, BOIs, and AJPs are now automatically subject to the new tax framework. If taxpayers would rather keep the current tax structure, they must opt-out. Form 10-IEA requires a person submitting an ITR 4 to opt out of the new tax system.

- ITR forms 4 now have a column revealing the amount available for deduction under Section 80CCH. The Finance Act of 2023 introduced Section 80CCH, which permits those who subscribe to the Agniveer Corpus Fund and are enrolled in the Agnipath Scheme on or after November 1, 2022, to receive a tax deduction for the entire amount put in the Agniveer Corpus Fund.

- The turnover threshold limit under Section 44AD for selecting for the presumptive taxation plan has been raised from Rs. 2 crores to Rs. 3 crores by the Finance Act 2023, provided that cash payments do not surpass 5% of the total revenue or gross receipts for the preceding year. Furthermore, Section 44ADA was modified to increase the gross receipts threshold limit from Rs. 50 lakhs to Rs. 75 lakhs, provided that cash receipts are at most 5% of the gross receipts total for the preceding year. The ITR-4 has been modified to incorporate a new column for revealing "receipts in cash" under Schedule BP to reflect these modifications. Payable checks and bank drafts that are not account payees fall under the concept of cash.

Method of Offline Filing

If you file your Income Tax Return (ITR) offline, you must send the Income Tax Department a bar-coded return or a physical paper form in exchange for an acknowledgment receipt.

This offline approach is acceptable in the following circumstances:

- The person is 80 or older, making them a super senior citizen.

- The person does not need to request a refund in their return because their income is less than Rs. 5 lakh.

- Note: Form ITR-4 must reach the CPC within 120 days from the date the return is electronically filed.

- The taxpayer will receive confirmation via the email address linked to their e-filing account that CPC has received their ITR.

Lawgical Adda will handle all of the paperwork so that your interactions with the government-run as smoothly as possible. We will also fully explain the procedure to you so that you can have reasonable expectations.

You can reach our team of knowledgeable business consultants by phone if you have any questions concerning the procedure. However, we'll try to answer any questions you may have before they come up.