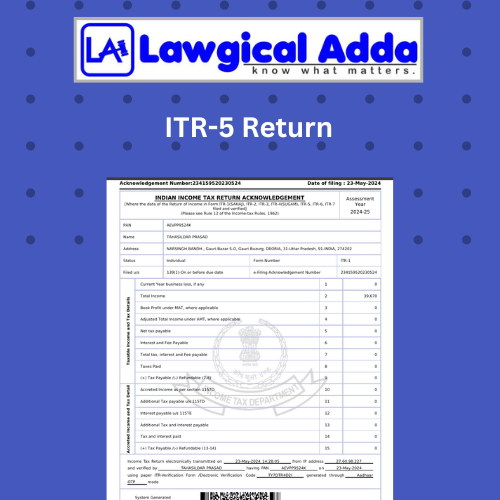

ITR-5 Return

Lawgical Adda is here to simplify your ITR 5 filing process!

What's Included?

- Financial Statements

- DIN E-KYC for 2 Directors

- GST Filing

- TDS Filing

- Income Tax Filing

- Annual Return Filing

- LEDGERS Platform

| Pricing Summary | |

| Service Price: | ₹1000 |

| GST: | ₹180 |

| Total | ₹1180 |

| Place Order | |

Have a Question?

ITR-5 Return

Every citizen must file an income tax return, which is required of all. The form that an assessee fills out and submits to the income tax department contains all of his tax and income information. Individuals, Hindu Undivided Families (HUFs), and businesses other than Limited Liability Partnerships (LLPs) are the intended recipients of ITR Form 5. In this blog, we shall discover the definition of ITR Form 5 and how to file it.

What is the ITR 5 form?

Individuals, HUFs, and businesses other than LLPs that conducted business during the fiscal year utilize ITR Form 5 as their return form. This form is for taxpayers who, in accordance with Income Tax Act sections 44AD, 44ADA, or 44AE, have chosen to participate in the presumptive tax plan. It is crucial to highlight that taxpayers with business earnings and income that are subject to "Capital Gains" taxation are not eligible to utilize this form.

Who can submit a Form ITR-5?

ITR Form 5 is filed by:-

- Association of Persons Firms (AOPs)

- Individuals' Body (BOIs)

- Artificial Juridical Person (AJP)

- The deceased's estate

- Estate of bankrupt Limited Liability Partnerships (LLPs) and investment funds

- An individual, business, HUF, or person filing an income tax return in the new ITR Form 7 does not file an ITR-5 form. Rather, the ITR-5 form is not available to anyone filing an income tax return under sections 139(4A), 139(4B), 139(4C), or 139(4D).

Who is not eligible to submit an ITR-5 Form?

- ITR-5 submission is not necessary for assessees who are obligated to file ITRs under Sections 139 (4A), 139 (4B), 139 (4C), or 139 (4D).

- ITR Form 5 filing is likewise not permitted for individuals or HUFs.

Steps followed by Lawgical Adda to help you submit the ITR Form 5

- Contact us through our portal. Our experts will connect with you to know your requirements.

- Send our professionals all the necessary documentation.

- Our professionals will file your income tax return online using the registered site. An ITR Filing Form will be chosen based on your category, and professionals will complete all the necessary fields and claim any relevant exemptions.

- After accounting for all exemptions, our professionals will advise you of any taxes that may be due.

- Your income tax return will then be easily filed after that.

- Lawgical Adda keeps you updated throughout the process to maintain transparency.

Major adjustments to the ITR-5 Form for AY 2024–2025

- Give the UDIN and Audit Report acknowledgment number.

- Indicate the amount that must be paid to MSME after the specified deadline.

- Detailed information about the use of the capital gains accounts program

- Specific information on contributions to political parties is requested under Schedule 80GGC.

- The declaration of bonus payment under LIC policies and the details about dividend receipts from IFSC units were included in Schedule OS.

- Startups under Section 80-IAC: The schedule requests details such as the business's kind, date of incorporation, certificate number from the Inter-Ministerial Board, first AY, date of claim, and amount of current AY deduction taken.

- Details about MSME, such as registration status and assigned registration number, are required.

Date of submission of ITR-5 Form

- The Income-Tax Act stipulates that accounts must be audited by October 31 of the assessment year.

- The deadline for submitting the report in Form No. 3CEB is November 30 of the assessment year.

- Otherwise (when an audit of the finances is not required) - July 31, the evaluation year

Are you still puzzled and unsure how to file the ITR-5 form? Legal Adda will automatically identify the appropriate form for your income when you file your ITR, so you don't need to worry. Submit your ITR right away.