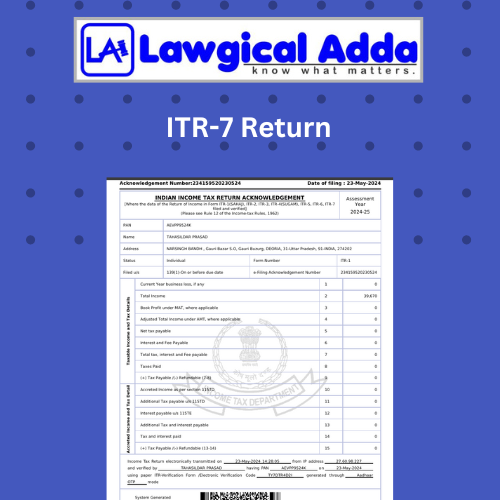

ITR-7 Return

File your income Tax Return with Lawgical Adda with in 4 Days

| Pricing Summary | |

| Service Price: | ₹1000 |

| GST: | ₹180 |

| Total | ₹1180 |

| Place Order | |

Have a Question?

Taxpayers need to complete the appropriate ITR form and submit it to the Income Tax Department by the designated deadline. Submitting an inaccurate or incomplete ITR can result in penalties and legal ramifications. Taxpayers have various options when it comes to completing the Income Tax Return Form 7. These options include using bar-coded forms, paperback forms, digital signatures, and filing return verification via ITR Form V. This article provides information on ITR Form 7, including eligibility criteria for filing and instructions on how to file it.

What is the ITR-7 Form?

Businesses that produce income from real estate used for religious or charitable organizations are required to file Form ITR 7. Properties that fall under trusts or legal responsibilities are included in this category. ITR-7 is filed when individuals and companies need to submit their returns in accordance with the specified sections.

- Section 139(4A) pertains to the income of charitable and religious trusts.

- Section 139(4B) deals with political parties.

- Section 139(4C) is applicable to scientific research institutions.

- Lastly, section 139(4D) applies to universities, colleges, or other institutions.

Who needs to submit Form 7 Filing?

- Individuals who receive income from property held under a trust or other legal obligation primarily for charity or religious purposes must file a return under section 139(4A).

- A political party must submit a return if its overall revenue exceeds the amount of money that is exempted from income taxation after applying certain provisions.

- According to the specified section, the following category is required to submit ITR Form 7 New Agency.

- Whether it's a hospital, university, fund, or any other educational institution, or an association or institution under section 10(23A),

- Any organization that promotes scientific research

- Every educational institution not obligated to report financial gains or losses through any other means must submit a return as per section 139(4D).

- Every business trust not obligated to provide a return for earnings or loss under another subsection of this section must file a return under section 139(4E).

- Investment funds mentioned in section 115UB must submit a return as per section 139(4F). No return of income or loss is required under any other provisions of this section.

Pro tip: Do not include any documents, such as the TDS certificate, when submitting the ITR-7 return form. It is recommended that taxpayers compare the taxes deducted/collected/paid by or on their behalf with their Tax Credit Statement Form 26AS.

Preparing and submitting audit reports electronically

Suppose the taxpayer is required to undergo an audit as per the provisions of the Income Tax Act or any other applicable law. In that case, they must furnish the necessary details of the audit report, including the auditor's information and the date of electronic submission to the department, in the designated "Audit Information" section.

How can I complete the verification document?

- Please complete all the necessary information in the verification document.

- Remove any items that do not apply.

- Make sure the verification is signed before submitting the return.

- Select the designation or role of the individual signing the return.

You can file ITR-7 with the Income‐tax Department electronically and verify it in one of the following ways:

- Using a DSC (digital signature certificate)

- Verifying through Electronic Verification Code (EVC) mode Aadhaar One-Time Password (OTP)

- Signing the ITR-V acknowledgment and mailing it to the CPC office in Bengaluru is necessary for tax filing.

- Remember that a political party must submit the return using a digital signature certificate (DSC).

It is important to be aware that making false statements in your tax return or accompanying schedules can lead to legal consequences. Under section 277 of the Income-tax Act, 1961, individuals who are found guilty of this offense can face rigorous imprisonment and fines.

Steps followed by Lawgical Adda to help you submit the ITR Form 7

- Contact us through our portal. Our experts will connect with you to know your requirements.

- Send our professionals all the necessary documentation.

- Our professionals will file your income tax return online using the registered site. An ITR Filing Form will be chosen based on your category, and professionals will complete all the necessary fields and claim any relevant exemptions.

- After accounting for all exemptions, our professionals will advise you of any taxes that may be due.

- Your income tax return will then be easily filed after that.

- Lawgical Adda keeps you updated throughout the process to maintain transparency.

Who is not eligible to file ITR using ITR 7?

The following taxpayers cannot file Form ITR-7: individuals, companies, and Hindu Undivided Families (HUFs) Organizations that submitted their tax returns using the new ITR-5 and ITR-6 forms.

Does ITR 7 require the disclosure of information on a tax audit?

Indeed, a business must provide certain information in ITR-7, including the audit report details and the date of submission to the department, if the business falls under the category of having its accounts audited under section 44AB and a chartered accountant conducts the audit.

When is the deadline for submitting ITR 7?

The deadline for auditing the accounts of all Tax Assesses is September 30.

The deadline for individuals whose accounts do not require auditing is July 31.

What conditions need to be met after submitting ITR 7?

After submitting the return, the assessee must print two copies of the ITR-V form. One copy should be mailed to the CPC office, while the other should be retained for your records.