Who Appoints the First Auditor of a Company?

Table of Contents

Introduction

By Section 139(6) of the Companies Act, a company must designate its first auditor within thirty days of formation using a resolution approved by the Board of Directors at its inaugural board meeting.

This article will include comprehensive details about the procedure for selecting an auditor and the first auditor for a business.

Procedure for Appointment of First Auditor of a Company

Step 1: Speak with the auditor and request the proposed appointment’s eligibility and consent letters.

Step 2: Call a board meeting to approve a board resolution and appoint a first auditor.

Step 3: Give the auditor the letter of appointment. ADT-1 forms may be submitted for appointment by reasonable corporate governance procedures.

Qualifications for Appointment of First Auditor

The Companies Act specifies strict requirements for eligibility. The company’s first auditor is appointed. First and foremost, the person chosen for this crucial position must be a licensed practising chartered accountant in India with active ICAI membership.

Furthermore, the designated auditor must hold a current Certificate of Practice, a document confirming their eligibility to work as a chartered accountant.

Additionally, if most of the firm’s members are active chartered accountants, a business may choose to engage a CA Firm as its initial auditor.

Procedure for designating an auditor other than the principal auditor

All firm members must attend a general meeting to elect auditors (apart from the first auditors). The current meeting is recognized as the auditor’s first meeting following appointment of first auditor and the auditor chosen by the general assembly takes office immediately following the meeting.

However, if a temporary vacancy in the auditor’s office results from registration, members’ consent must be acquired within three months of the Board’s decision date.

The auditor selected at the gathering will remain employed until the annual general meeting of that year. Within fifteen days of the appointment of first auditor or new auditor, the Company must file ADT-1.

Documentation and the Filing Process

Accuracy is required when filling Form ADT-1 for the appointment of First Auditor of the Company. Getting a Digital Signature Certificate (DSC) and downloading the form from the MCA website are your first steps.

Verify the complete form, attach any necessary papers, and submit it through the MCA portal along with payment. This meticulous methodology guarantees a streamlined procedure, preventing delays in conformance. These are the specifics you ought to be aware of.

Obtain a Digital Signature Certificate (DSC): To digitally sign the document, the designated auditor and any firm directors must possess a current DSC.

Complete Form ADT-1 by downloading it from the Ministry of Corporate Affairs (MCA) website and accurately entering the required information.

Add supplementary files: Prepare the necessary paperwork for submission, such as the board resolution, the auditor’s consent letter, and any other pertinent papers.

Check the form: Examine the completed form to ensure it is accurate and prevent any errors or rejections throughout the filing process.

Send in the form: Completed forms and supporting documentation should be uploaded to the MCA site and submitted there.

Pay the amount due: Remit the required filing costs listed in the next section.

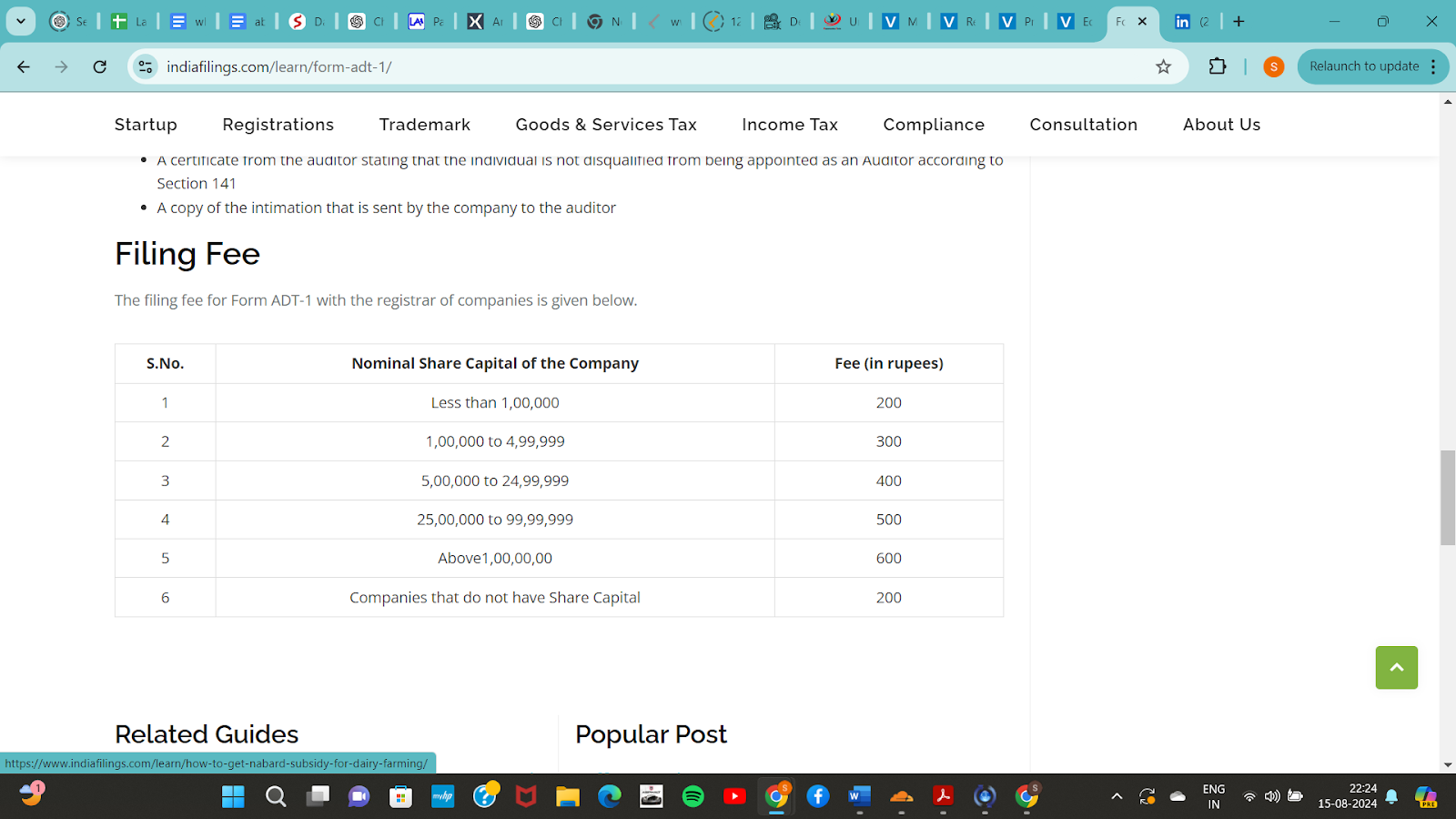

ADT-1 Charges

It is essential to manage the financial components of the company’s appointment of first auditor and comprehend the required filing fees for Form ADT-1. The costs connected with this procedure are established by the authorized share capital of the business and are essential to guaranteeing adherence to legal requirements.

Conclusion

Every firm appoints its auditor in compliance with Section 139 of the Companies Act of 2013. Public Company statutes are more stringent when appointing auditors than Private Company laws.

For example, a listed business can only select the same auditor for up to five consecutive years. At that point, the auditor of a publicly traded company may only work for a firm of auditors for up to two terms or five years in a row.

You may confidently handle this process if you know the legal framework, eligibility requirements, deadlines, filing procedure, costs, and penalties.

To prevent fines and maintain compliance, remember to plan, get expert help when needed, and stay current on the most recent rules. Let’s work together to create a solid basis for the financial management of your business.

Navigating the complexities of company registration? Lawgical Adda simplifies the process. From Section 8 to Public or Private Limited Companies, we offer expert guidance and seamless company name availability checks.

Our comprehensive corporate governance and secretarial compliance solutions cover your business’s entire lifecycle. Let Lawgical Adda handle the intricacies while you focus on growth. Contact us today for expert support.