IBBI Issues Fresh Guidelines for Insolvency Professionals (IPs) in 2024: Interim Resolution, Liquidation and Bankruptcy Trusts

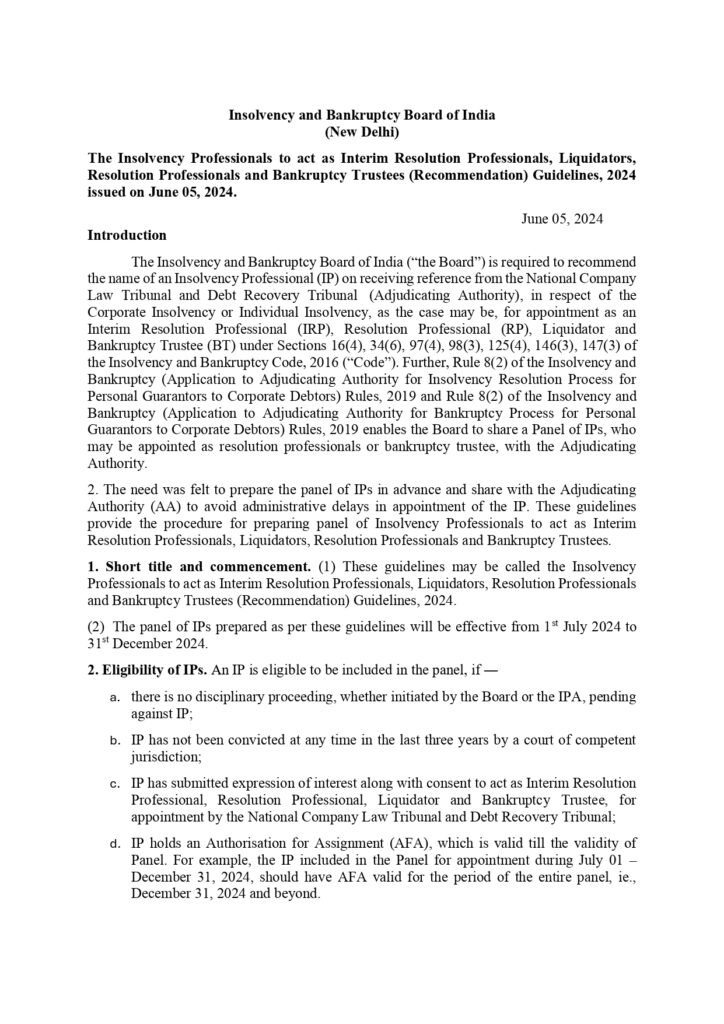

The Insolvency and Bankruptcy Board of India (IBBI) has issued new guidelines to name Insolvency Professionals (IP) to act as Resolution Professionals (RP), Interim Resolution Professionals (IRP), Bankruptcy Trustees (BT), and Liquidators. The guidelines are called the Insolvency Professionals to act as Interim Resolution Professionals, Liquidators, Resolution Professionals, and Bankruptcy Trustees (Recommendation) Guidelines, 2024. These guidelines were issued on 5th June, 2024, and apply to both, corporate insolvency and individual insolvency.

Table of Contents

IBBI felt the need to prepare the panel of IPs in advance to avoid issues related to administrative delays and ensure smooth completion of compliance.

The panel will be effective from 1st July 2024 to 31st December 2024.

What is IBBI?

The full form of IBBI is the Insolvency and Bankruptcy Board of India. It was found in 2016 as an essential element of the financial and corporate ecosystem. This institute was established under the Insolvency and Bankruptcy Code, of 2016, and compiled laws related to restructuring and insolvency resolution of various entities. The code applies to individuals as well. The code aims to maximize profits, promote entrepreneurship, bring availability of credit, and balance the interests of all stakeholders for corporates, firms, and individuals undertaking restructuring or opting for insolvency.

What are Insolvency Professionals (IPs)?

An Insolvency Professional is any professional who has registered himself with the IBBI. They work with an Insolvency agency and help various entities with their dissolution process. The professionals act on behalf of the entities. IPs have gained enormous significance due to the introduction of strict government norms through the Insolvency and Bankruptcy Code.

An IP is eligible to be included in the panel under these guidelines, if ―

a. there is no disciplinary proceeding, whether initiated by the Board or the IPA, pending against IP;

b. IP has not been convicted at any time in the last three years by a court of competent jurisdiction;

c. IP has submitted an expression of interest along with consent to act as Interim Resolution Professional, Resolution Professional, Liquidator, and Bankruptcy Trustee, for appointment by the National Company Law Tribunal and Debt Recovery Tribunal;

d. IP holds an Authorization for Assignment (AFA), which is valid till the validity of the Panel.

The IPs cannot withdraw their consent or refuse to accept the appointment unless otherwise

permitted by the National Company Law Tribunal or Debt Recovery Tribunal or the Insolvency

and Bankruptcy Board of India, in accordance with the law. Any refusal to act as IRP,

Liquidator, RP or BT, as the case may be, on being appointed by the AA, without sufficient

justification, will be treated as deviation from consent and name will be removed from panel

for six months.

The board shall invite expression of interest from IPs through electronic modes of communication. The board can do this by sending an email to the IP on their registered email address. The email should be registered with the board.

The IP shall declare their expression of interest in Form A along with the sectors that they have worked in under this code. They can choose these sectors from the drop-down menu in the form. They can also choose the option ‘other’ and mention the name of the sector not included in the drop-down menu.

Submission of this form is unqualified consent by the IP to act as an IRP, liquidator, RP, or BT. The debtor can be a corporation or an individual. The board has to submit this Panel to the AA by June 28, 2024.

The Panel will have a zone-wise list for individual IPs based on the registered office. The panel of IPE as IP will be valid across all NCLT benches. The AA can pick up any name for appointment at appropriate positions. You can know more about corporate compliance here.

Read the whole circular here: