Promoting Financial Inclusivity: Understanding the Implications of Section 43(B)(h) for MSMEs in India

The Finance Act 2023 introduced an amendment to the Income Tax Act by adding clause (h) to Section 43B. This clause states that any payments owed to MSMEs which are not cleared within 45 days, will not qualify for tax deductions until the payment is made. But what is section 43(B)(h)?

Table of Contents

Who are the Micro Small Medium Enterprises (MSMEs)?

Any industry with a turnover of or less than ₹5 crore and an investment equal to or less than ₹1 crore is termed a micro company under the MSMED Act, 2006 amendment. Similarly, a small company has a turnover equal to or less than ₹50 crore and a capital investment equal to or less than ₹10 crore.

Why was the rule established?

The Indian government introduced Section 43(B) of the MSME Development Act, 2006, to address the prevailing issue of delayed payments faced by Micro, Small, and Medium Enterprises (MSMEs) in India. Several factors, like credit issues and delayed payments, led to the formulation of this rule. Some of them were:

1. Lack of Bargaining power: MSMEs are smaller enterprises as compared to big companies or multinational corporations. MSMEs have comparatively lower capital and asset investments. This difference in capital results in an unequal allocation of bargaining power to MSMEs.

2. Lack of trust and dependency: Delayed payments erode the relationship and trust between the buyers and the suppliers.

After studying these and many more challenges, the government of India established Section 43(B) as a preventive measure to address the systemic issue of delayed payments and safeguard the interests of MSMEs.

The Essence of Section 43(B)(h)

Section 43(B) of the Income Tax Act, 1961, was amended by the Finance Act 2023 by adding clause (h) to subsection (B). This amendment applies to all micro and small industries, whether registered or not. It is not mandatory for MSMEs, i.e., Sukshma, Madhyam, and Laghu udyog registration, to demand payment through the MSME payments system.

However, Section 2(n) defines suppliers as a micro or small enterprise (not medium) that has filed a memorandum with the authority referred to in Section 8(1). This is commonly known as the Udyam registration as well. So, after analyzing Section 2(n) and Section 8(1), it can be inferred that disallowance under Section 43B cannot be invoked without Udyam online registration.

Implications of the amendment: The obedience of Section 43(B) will ensure the timely settlement of invoices raised by the MSME suppliers.Buyers will have to clear their creditors within 45 days of the purchase of goods in case of written agreements or in 15 days in the absence of agreement.

Any kind of failure to comply with this section will result in a monetary penalty and the charge of compound interest at the current bank rates as specified by the RBI. Also, this purchase of the buyer will be treated as his income under the Income Tax Act, 1961, and he’ll be liable to pay additional tax. He will not be eligible to avail the deduction in the transactions entered with the MSME. Additionally, non-compliance can damage the buyer’s reputation and adversely affect business relationships with MSMEs.

Delayed Payment Monitoring system

The Delayed Payment Monitoring System (DPMS) is an online platform created by the Government of India. The DPMS was developed to tackle the problem of late payments to Micro, Small, and Medium Enterprises (MSMEs). The platform helps the suppliers to keep a track of payments that buyers owe to MSMEs and promotes transparency and accountability in the payment procedures.

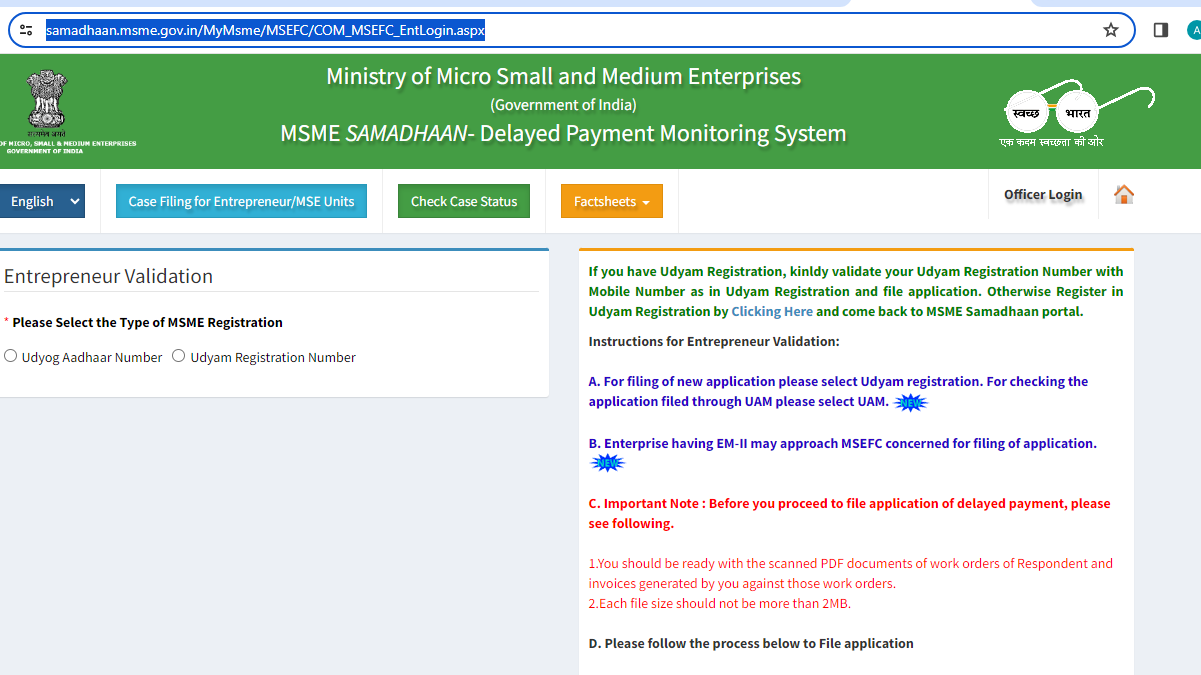

The DPMS also aids MSMEs and buyers to solve the disputes between them by providing a centralized system for recording grievances. Here is how you can file an application for delayed payment on the Delayed Payment Monitoring system:

- You can visit the DPMS website here: https://samadhaan.msme.gov.in/MyMsme/MSEFC/MSEFC_Welcome.aspx

- For getting an Udyam online registration, users can choose the option A on their official website.

- After getting a Udyam registration number, enter that or your Udyam Aadhar number in the specific field.

- For getting an Udyam online registration, users can choose the option A on their official website.

- After getting a Udyam registration number, enter that or your Udyam Aadhar number in the specific field.

- After entering the particulars and the verification code, you will have to verify your application with the help of an OTP received on your registered email address

- Suppliers can upload invoices onto the DPMS platform, specifying details such as invoice number, date, amount, and buyer information.

- The system allows MSMEs to monitor the status of their invoices, including whether they have been accepted, pending, or delayed beyond the stipulated payment period.

In conclusion, MSME update via Section 43(B) (h) serves as a foundation for promoting financial inclusivity, fostering business ethics, and nurturing a conducive environment for MSMEs to thrive.